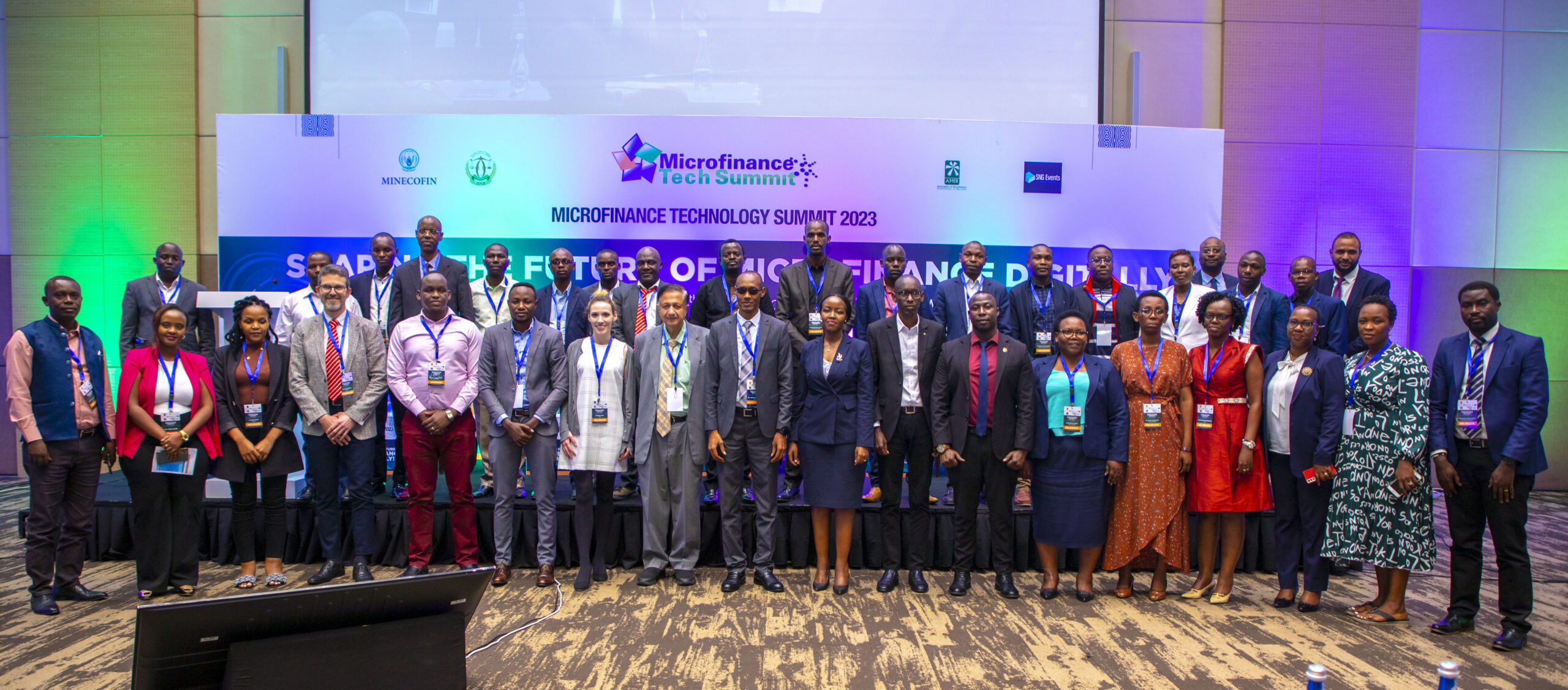

The Association of Microfinance Institutions in Rwanda (AMIR) in partnership with SNG Events organized an event under the name “MICROFINANCE TECHNOLOGY SUMMIT” for its very first time to take place in Rwanda. The event happened within two days from 28th to 29th March 2023, and it was all about embracing digital financial solutions in Rwanda Microfinance Sector, under the theme “SHAPING THE FUTURE OF MICROFINANCE DIGITALLY”. The Summit brought together a big number of Fin-Tech companies with great solutions and different delegates from around the world and within Rwanda especially those under the Microfinance Sector.

On the first day the event started with welcoming remarks by the EXECUTIVE DIRECTOR of AMIR, thanking the government of Rwanda for the technical and material support during the organization of the summit especially the Ministry of Finance and Economic Planning, The Ministry of ICT and Innovation, BNR, RCB, RCA, … for their support. Thanked also the partners, sponsors and speakers who accepted to come and share their experience with over 300 delegates.

Followed by the HONORABLE GOVERNOR of the National Bank of Rwanda who was the guest of honor and was there for the Inauguration of the Event. He appreciated AMIR and partners who worked together to organize this summit and to invite technology institutions in the country, Africa and around the global. He mentioned that the microfinance sector in Rwanda was left behind in the financial sector, the digital drive where the automation level is still low with only 23% microfinance institutions fully automated which creates a lot of inefficiencies and increased to more than 60% by digitalizing 416 Umurenge SACCOs. He also requested Fin. Techs around and financial institutions to think of the solutions to potential cyber threats and collaborate with BNR is implementing the Financial Security Operation Center and IT Security Umbrella that will provide a centralized cyber threats information sharing within the financial sector.

On the first day we also had presentations from different sponsors with Fin-tech solutions, by the CEO & Managing Director of Virmati Software and Telecommunications, The COO & Co-Founder of Identity Pass Nigeria, and The Founder & and CEO of Eclectics Kenya. We also had a panel discussing Women in finance and Technology.

On the second day, which was the last day of the event, we had two presentations from DSIK Tanzania on Maximizing SACCOs potential and Optimizing Loan Operations of SACCOs through Digital Field Application. We also had a presentation from the COO & Co-Founder of Quore Kenya, about becoming digital first. We also had two panel discussions, the first one discussing Bridging the gap between the Microfinance sector and Tech solutions to maximize efficiency in service delivery. The second panel discussed whether Policy Makers are considering digitalization.

Lastly the closing speech was by the Honorable Minister of ICT and Innovation. In her speech she said that Microfinance Organizations have played a role of filling the gap of missing financial services to the population, and encouraged the implementation of security solutions in technology services. She said that as the Microfinance sector continues to be a lifeline to millions of people across the continent the role of the government is to put in place and enable policies and regulations that are going to allow the sector to drive the impact even further, and create more impact than it has ever been in the sector.

PHOTOS: