World Savings Day started on 31st October 1924, during the 1st International Savings Bank Congress in Milano Italy, and in 1989, the United Nations officially declared that the day should be devoted to the promotion of savings all over the World. Since 1924, 31st of October has been celebrated as International Savings Day where the population is sensitized on the importance of saving. World Savings Day was celebrated this year on 31st October 2023 with the theme; Your Savings, your Sustainable Growth, “Ubwizigame Bwawe Iterambere Ryawe”.

In this context, for AMIR to provide its contribution and participate in the increased public awareness of the importance of savings both for individuals and for the country, together with its members and partners, including consortium members under the SERVE project, (CARE INTERNATIONAL RWANDA, Pro-Femme/Twese Hamwe, Duhamic Adri, Urwego Bank), Government agencies such as the Ministry of Finance and Economic Planning (MINECOFIN), Local Government like Districts and Provinces, RICEM and Media Houses, organized and participated in awareness campaign events including open days across the country especially in the Districts of Gakenke, Rulindo, Rubavu, Nyabihu, Nyamagabe, Ngoma, Rwamagana, and Kirehe respectively.

This year, Savings Week started on the 23rd-31st of November 2023, it was a good opportunity for AMIR to deliver Financial Education messages to the users and non-users of microfinance services across the country. This was to clearly explain to customers and Rwandans, in general, the importance of SAVING and the progress you can achieve by doing that action of SAVING, where it is explained that saving is not about having more income because you will always be in need, but that you must first have a goal/target, and know what you want to achieve, so you have to make some sacrifices to be able to save and in that line you will be able to achieve the goal you have set.

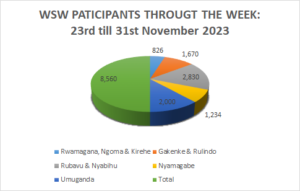

Below is a Pie-Chart that shows the number of participants that attended the campaign events across 8 Districts:

The savings week was officially closed in partnership with the Western Province, Rubavu District. A big day that brought together more than 2 thousand participants was organized on 28th November 2023 in Rubavu sector, Byahi cell, and Ngugu village during UMUGANDA day. The honorable governor of Western Province was the guest of honor, the event was attended by other officials from security organs including the Police and Army. The Mayor of Rubavu district, different journalists for various media houses, citizens of Rubavu District, MFIs and SACCOs, Banks, development partners and other partners of AMIR attended the event.

The day started with planting more than 6,000 trees on Mount Rubavu,from there, the awareness event on saving culture started. Youth got the opportunity to share their testimonies with the public about their saving journal, educational sketches, poems and songs that sensitized people to adopt saving culture were played during the campaign. During the event, AMIR highlighted some of the available opportunities including the SERVE project that will help in creating dignified and fulfilling jobs for predominantly female youth. The project can also facilitate them to achieve their saving goals through access to affordable and appropriate financial products focusing on 4 value chains for 5 years; Tomatoes, Green beans, Pepper and Poultry.

Mr. Jackson KWIRIZA, Executive Director of the Association of Microfinance Institutions in Rwanda (AMIR), in his speech, thanked the partners for their contribution to the development of Rwandans through financial institutions and urged the public to save through these institutions for further development, saying “no one can thrive without saving and saving will not be enough, but investment is needed for the development of the community and the country.

The Governor of the Western Province, Mr. DUSHIMANA Lambert, the guest of honor in his speech reminded Rwandans that to avoid begging in retirement requires making savings at a young age.

Pictures: