Microfinance Institutions (MFIs) have been at the forefront of poverty alleviation efforts around the world and in Rwanda particularly. Of course, for MFIs to achieve this, they must properly employ some strategies; some of these strategies – one may certainly bring up the information technology strategy. According to different and various reports and surveys, Information Technology can be a strategic tool for boosting microfinance services in Africa. It can allow more efficient and effective collection, processing and use of data; it opens the door for microfinance institutions to offer new products and better customer service; it enables greater outreach; and it facilitates integration with the rest of the financial sector.

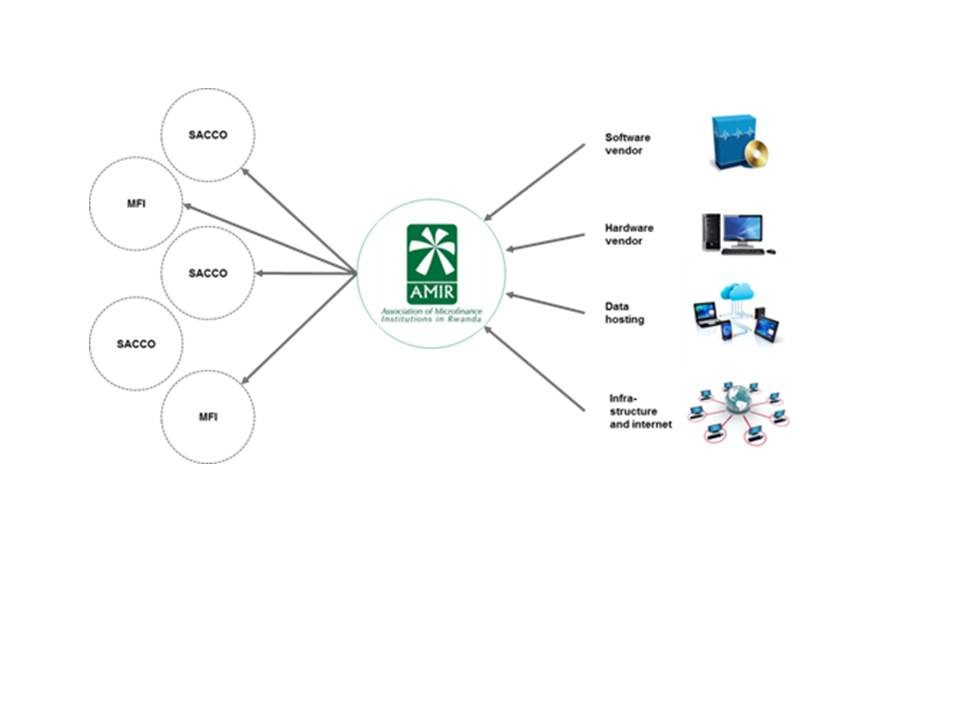

Rwanda is an ICT based country and it has good IT policies, it wants to use modern technologies to foster and achieve cashless economy as well as reaching financial inclusion goals which is attaining a rate of 90% by year 2020.The IT infrastructure in Rwanda is well established and this is a good opportunity for the success of the shared MIS platform specifically in the microfinance sector. AMIR, being a professional umbrella of microfinance institutions (MFIs), savings and credit cooperatives (SACCOs) strives to support its members to become professional and sustainable institutions. Through different services namely IT services par excellence.

In the general assembly of AMIR members which took place in December last year, AMIR members expressed their strong wish and thirst about technology services: shared IT platform composed of core banking system, hardware, connectivity, payment system and digital finance services; and this was like a “rocket booster” for AMIR to introduce its MIS project that it had been designing longtime ago. The AMIR management told media that Rwanda Microfinance sector is well harmonized with sufficient microfinance policies, law and regulation. The shared MIS platform once going live with at least 70% of AMIR members joining, will definitely set precedent in the region and Africa in general; making a proof to the entire world that Rwanda microfinance sector is digital, hence attracting investors to MFIs and SACCOs. Additionally, the management promised that there will be great benefits for all partners of the AMIR Shared IT-Services namely sustainable improvement of Rwanda’s Microfinance Sector, and sustainable business opportunity.

On the other hand the microfinance practitioners have a feeling that this service will be an opportunity for: Automation of core banking and management procedures; Strengthening competitive ability in a long-term perspective; Reduction of IT –efforts; Improvement of data quality for accountancy; Improvement of security and fraud prevention because of automatic internal controls; Fulfillment of regulatory requirements through IT and automatic reports.

Though the pilot phase for this project will kick off on 1st June 2016; there are some important and tremendous achievements recorded so far, as it was revealed by the technical team in charge of the implementation of this project, we should note specifically:

- selection of the software vendor as a business partner of the AMIR Shared IT-Services

- 25 pilot institutions have been identified; Collection of basic data of AMIR members (ongoing)

- Project MOU Signing workshop between AMIR and 25 identified MFIs/SACCOs members, for taking part in the pilot phase

According to the project projections, the pilot phase (1) targets 272,236 customers, and will reach a total target market of 400,000 customers in total in project phase (2), with the below electronic payment channels added to the platform:

- Agency Banking: 50% (200,000 customers)

- Mobile Money: 50% (200,000 customers)

- Mobile Banking: 30% (120,000 customers)

- ATM: 30% (120,000 members)